How corporate America won the fight to keep its pollution secret

Polluter lobbying, conservative courts, and the Biden Administration all played a role.

One of the biggest challenges in holding corporations responsible for the climate crisis is that we have no idea how much they’re polluting. And corporate America is fighting tooth and nail to keep it that way.

Sure, there are corporations that try to earn green points by voluntarily disclosing their greenhouse gas emissions—ExxonMobil is one, Walmart is another. But currently, under federal law, there is no rule requiring companies to accurately calculate or divulge their full impact on the planet. Nor is there a rule saying that companies have to report how the climate crisis is impacting their business, and hurting their bottom line.

All that was set to change when the most powerful financial regulatory body in the country decided that the climate crisis was a “significant risk” too big to ignore. In 2022, the U.S. Securities and Exchange Commission (SEC) proposed a climate disclosure rule that would have forced public companies to report their greenhouse gas emissions—from their direct emissions (also known as Scope 1 emissions), to emissions from their energy use (Scope 2), to emissions from their supply chain (Scope 3). It also would have required that companies report how climate change is impacting their bottom line.

But that’s not what happened. Instead, on Wednesday, the five-person SEC voted to adopt a climate disclosure rule that was significantly watered down. It is no longer mandatory for companies to report their emissions; instead it says that companies should disclose their greenhouse gas emissions if they consider them “material”—in other words, of significant importance to their investors. It made no mention of Scope 3 emissions, which are the largest portion of any company’s pollution. (For example, 80 percent of Exxon’s emissions are Scope 3).

The changes are the result of a two-year pressure campaign by corporations, anti-climate conservative foundations, anti-ESG lawmakers, and the agriculture lobby. These well-funded groups met with the SEC, wrote letters, and submitted some of the 24,000 comments on the climate rule—the most comments the SEC has ever gotten.

If you’re not familiar with the SEC, here’s how powerful it is: the SEC effectively put Martha Stewart in jail for insider trading, bankrupted Enron for fraud, and found cryptocurrency FTX founder Sam Bankman-Fried guilty of fraud. The SEC is not afraid of corporate America. So why did it cave to interest groups here?

The answer lies in the conservative judges all over the country— many of whom are Trump-appointed—striking down federal climate regulations. According to Clara Vondrich, senior policy counselor at consumer advocacy nonprofit Public Citizen, the world’s most polluting industries and GOP lawmakers threatened to sue if the SEC required them to report all their emissions. Those were not empty threats—within hours of the final rule being adopted, 10 Republican-led states had sued the SEC for overreach.

This chilling effect by “a radical judiciary is not the way democracy is supposed to work,” Vondrich told me in an interview on Tuesday. We spoke about the myriad forces holding back corporate climate accountability—and talked about an “astounding” conversation she had with the SEC chairman last week.

When asked what she thought of the SEC’s changes, Vondrich said, “You know how a human has a beating heart? Without the beating heart, the person dies. It's a very stark metaphor, but essentially that's what the SEC has done.”

This interview has been edited for length and clarity.

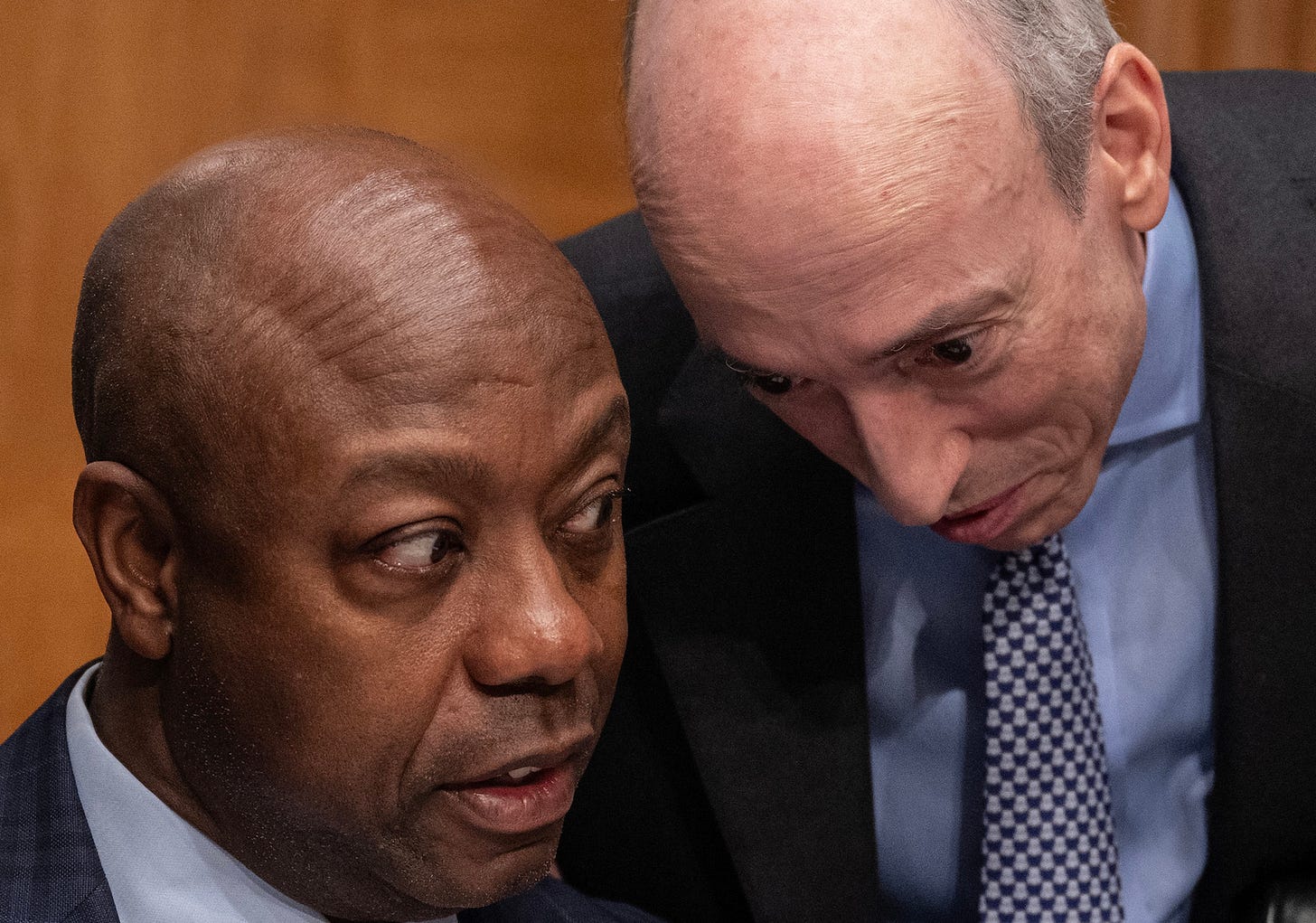

Arielle Samuelson: You talked to SEC Chair Gary Gensler on the phone last Friday. What did he tell you?

Clara Vondrich: Well, he told us a very interesting anecdote about pinball, which really left me astounded.